How to Automate RBI Compliance Notifications with AI Agents

If you are part of a financial institution (Banks or NBFCs), you will know how important it is to make sure you remain compliant with financial regulations and industry standards. Failure to do so can result not only in staggering fines from regulatory bodies but also in the loss of a hard-earned reputation and customer trust.

But the question remains: why is staying compliant so difficult?

Compliance teams know this way too well. Regulations change rapidly, are fragmented across documents and are frequently updated. Monitoring, interpreting and escalating these notifications can be very cumbersome and manually driven.

The result? Delayed alerts, inconsistent interpretations, missed deadlines–which is exactly what leads to huge fines, adverse audit findings and not to mention increased supervisory scrutiny.

The Solution: NextNeural’s Compliance Agent

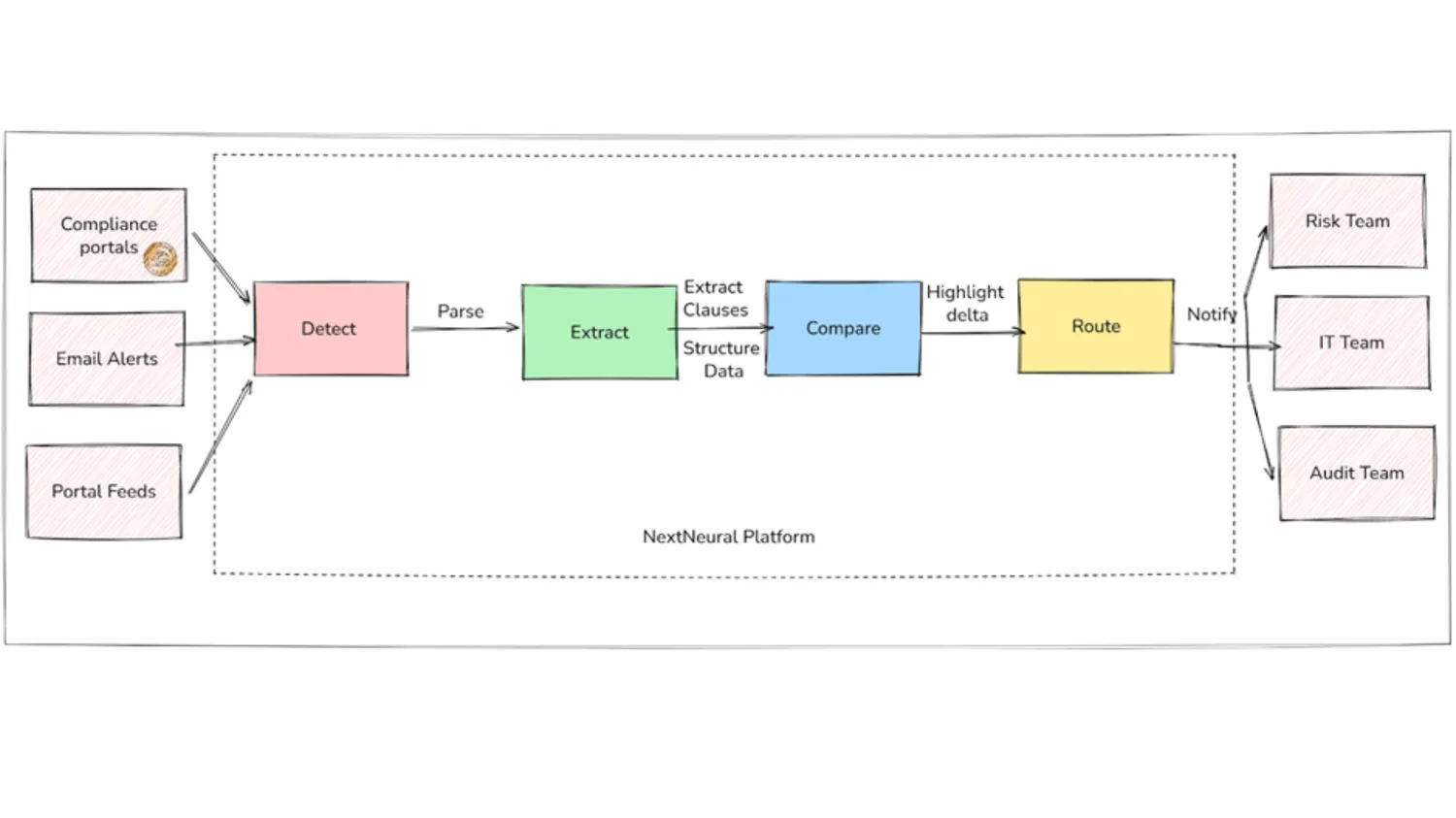

NextNeural’s Compliance Agent is built to address this challenge, especially for the BFSI sector. The agent monitors RBI portals, repos and regulatory updates. Anytime there is a regulatory circular that is issued by authorities such as the RBI, SEBI, IRDAI, etc. you are instantly notified of its release via Slack, email or internal dashboards.

The Agent scans circulars and performs a delta detection to tell you exactly what is new, what is superseded, and what remains unchanged.

This leads to a significant reduction in manual review effort and helps you and your team stay on top of any regulatory amendments while complying with deadlines.

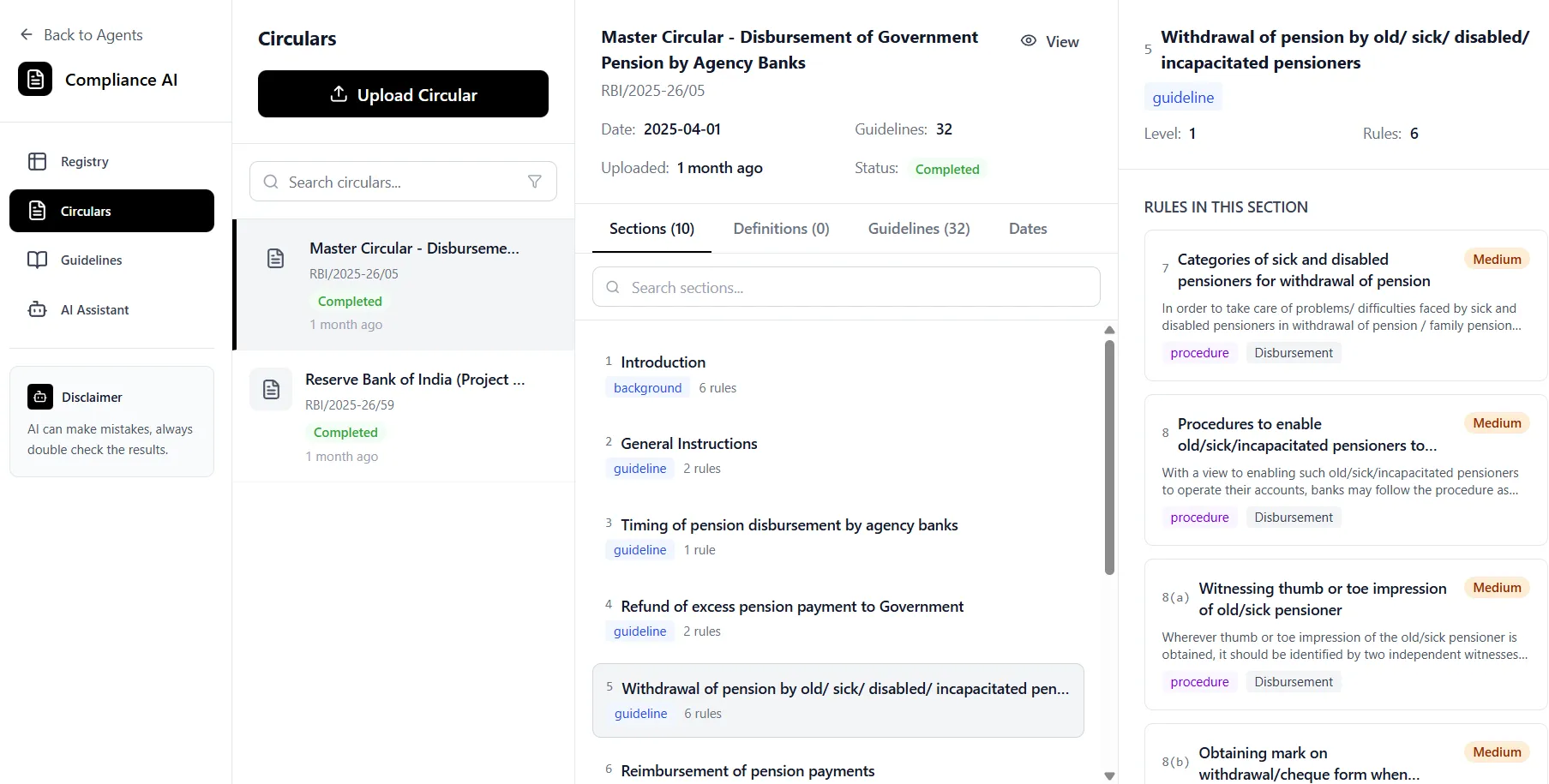

Using the NextNeural Compliance Assistant: A UI Walkthrough

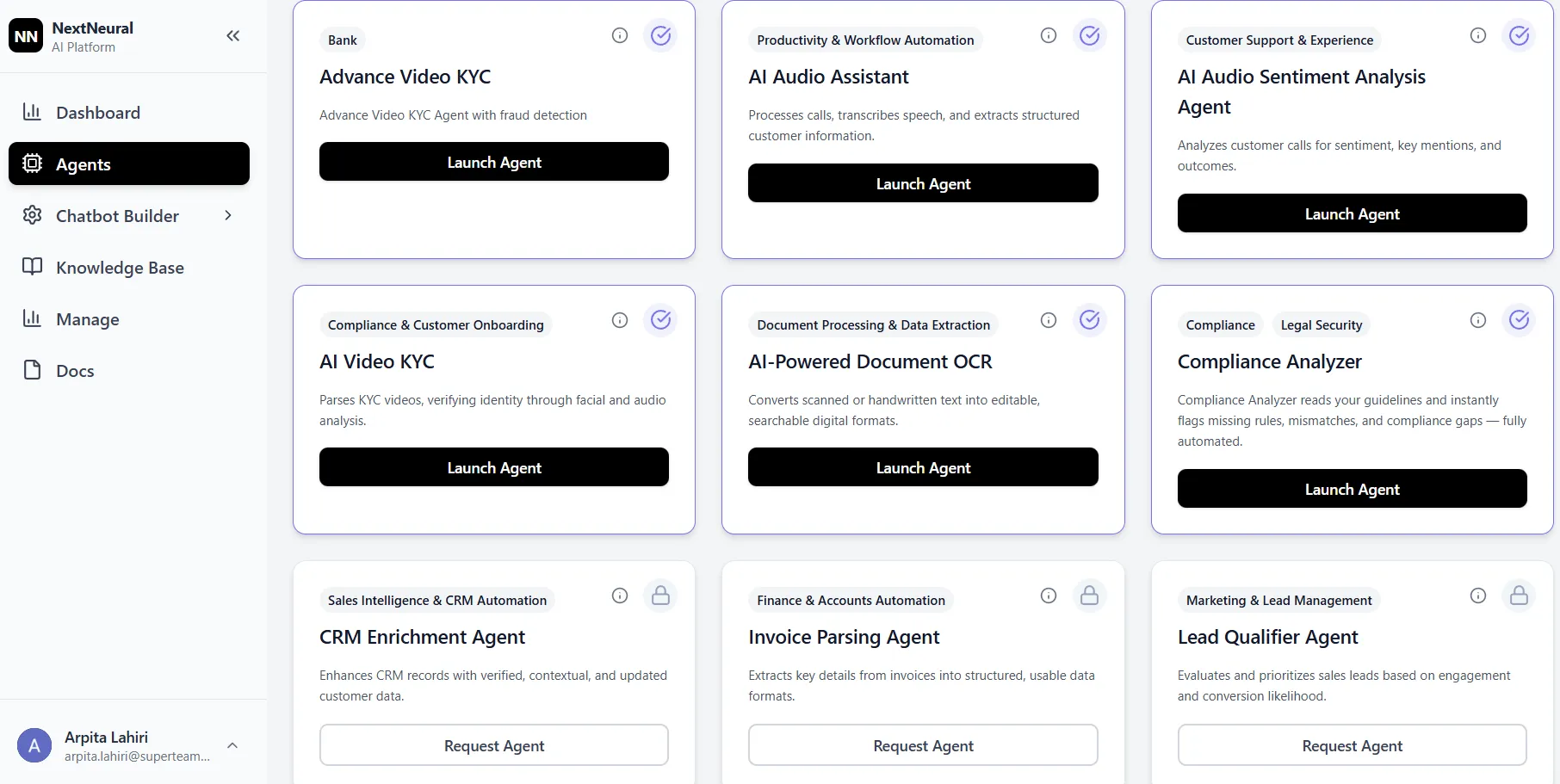

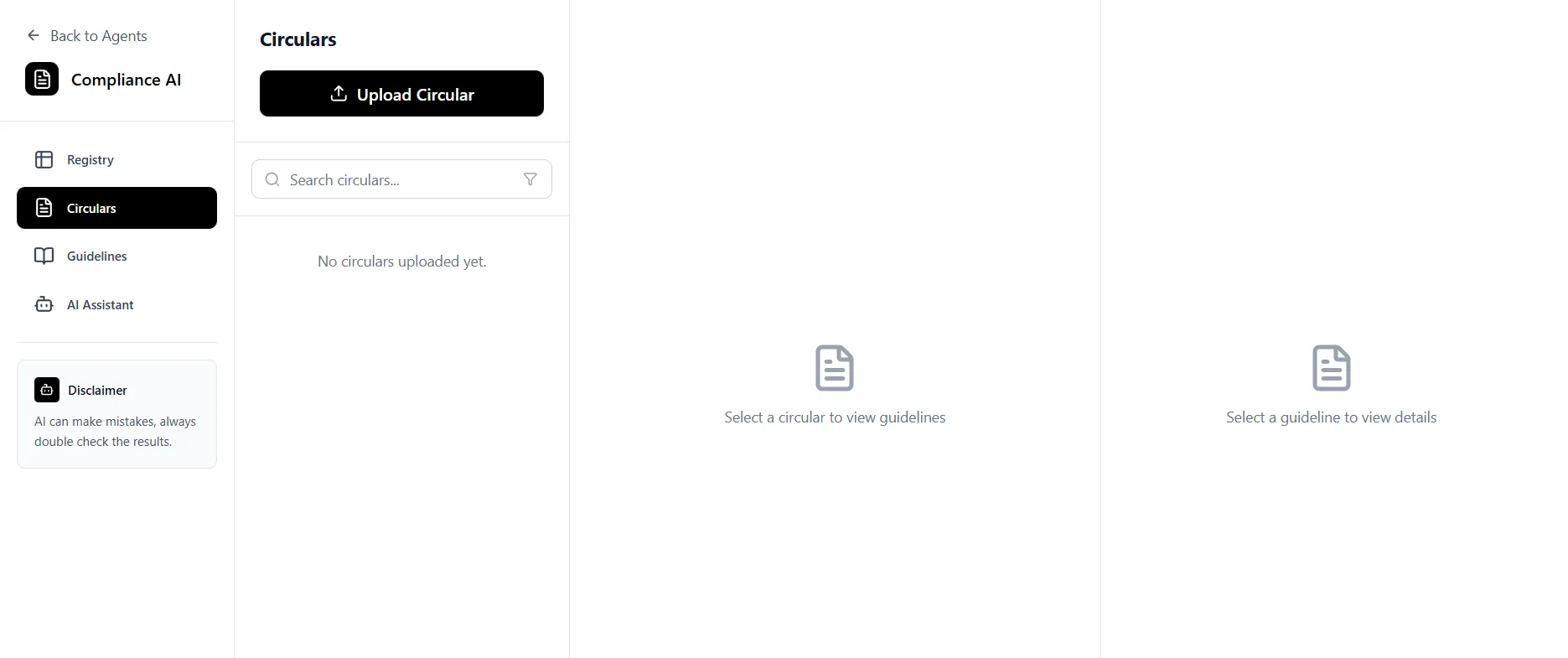

Step 1: Launch the Compliance Agent

First, go to the NextNeural dashboard and launch the Compliance Assistant agent. This starts the compliance workflow and makes the ingestion, guideline, and AI Assistant modules available.

Step 2: Upload Regulatory Documents

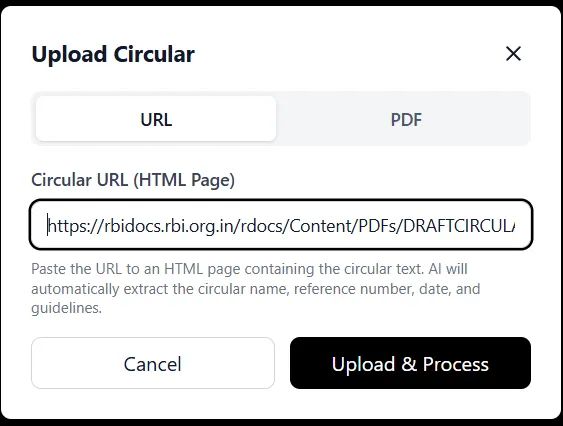

You can upload the regulatory documents in two ways:

- Using a URL (for example, directly from RBI’s document repository)

- Uploading a downloaded PDF from your system

Once uploaded, documents appear under the “Circulars” section.

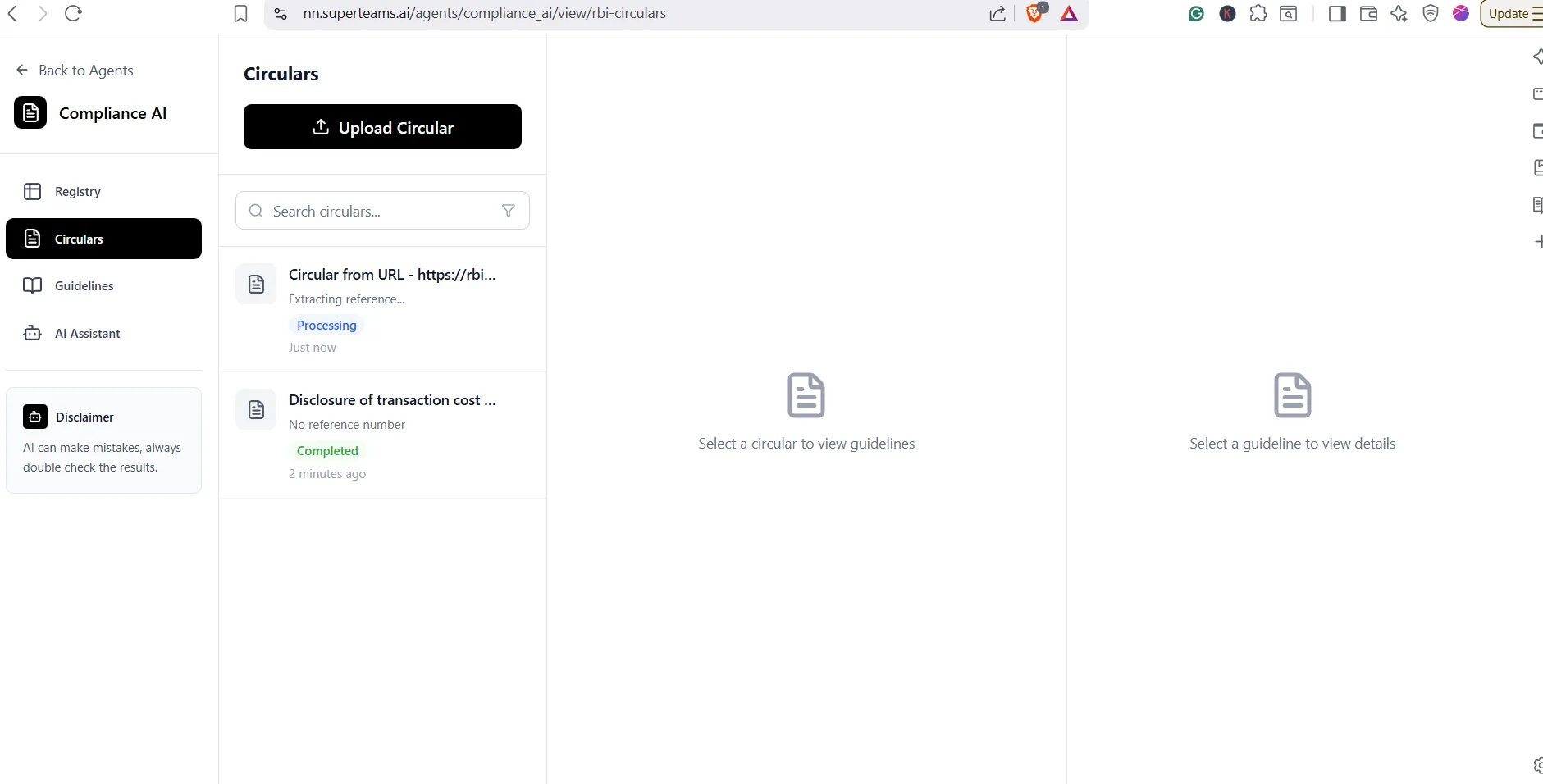

Step 3: View Uploaded Circulars

All uploaded documents are listed in the Circulars view, providing visibility into:

- document source

- upload status

- processing state

This acts as the central registry for all regulatory inputs.

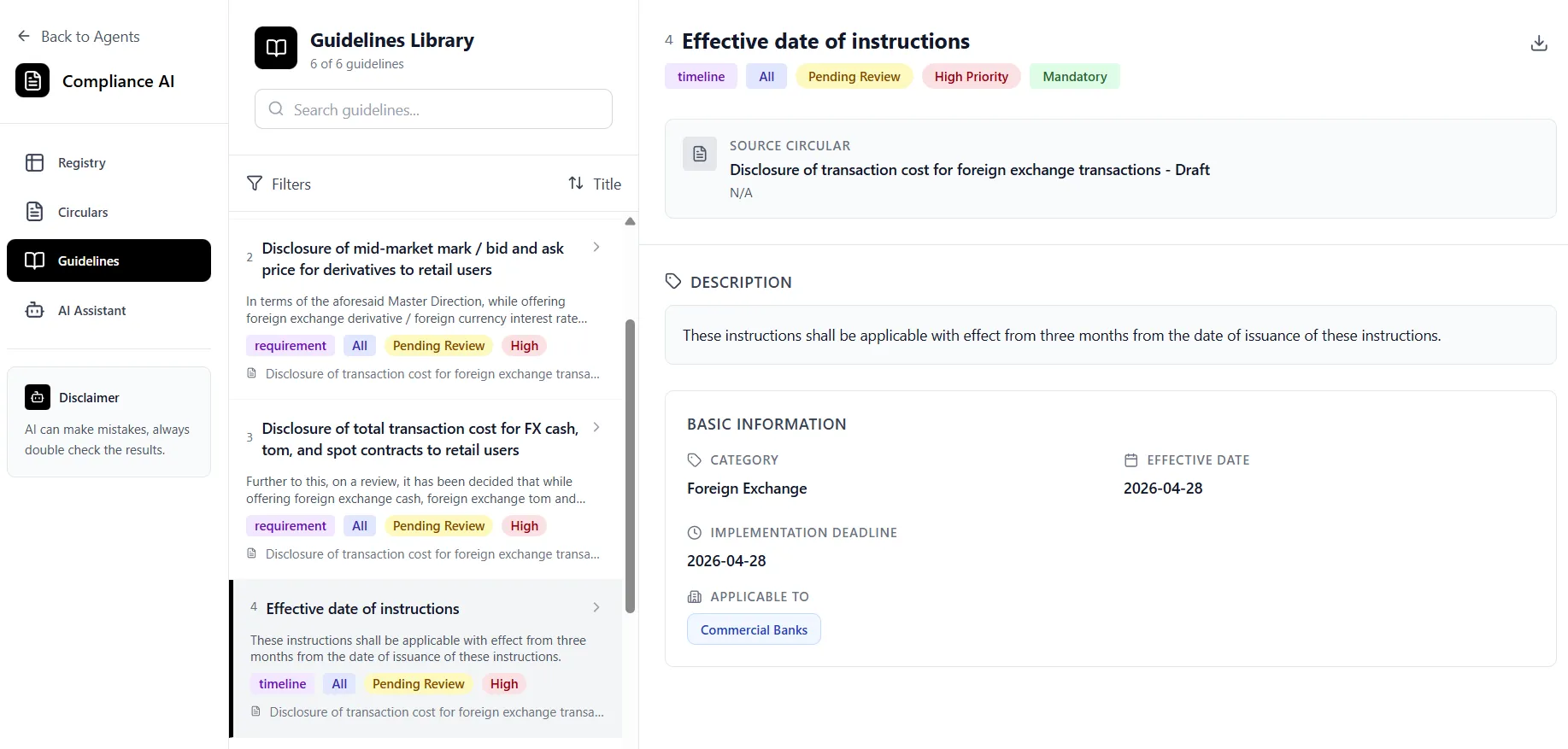

Step 4: Explore Extracted Guidelines

Click on Guidelines to view the structured outputs generated from each circular.

Here, guidelines can be:

- filtered by title

- prioritised by importance

- sorted by effective date

This replaces raw PDF scanning with a structured compliance layer.

Step 5: Query Using the AI Assistant

Click on the AI Assistant to ask questions directly about the uploaded documents.

Examples:

- What does this circular discuss?

- What compliance obligations apply to banks?

- Which inter-bank transactions are covered?

Responses are grounded entirely in the uploaded circulars. We will use two circulars. You can download them here:

Moving from Monitoring to Regulatory Intelligence

NextNeural’s Compliance Assistant gives banks and NBFCs a practical way to track regulatory updates in real time, understand what has changed, assess impact instantly, and act before deadlines are missed. By transforming unstructured circulars into structured, searchable, and explainable guidelines, compliance teams can move from reactive firefighting to proactive governance.

If you are part of a BFSI compliance, risk, legal, or audit team, we invite you to sign up and test the platform. Experience firsthand how NextNeural helps you track and report on impactful regulations and compliance requirements on time.