How to Use AI to Automate Video KYC for BFSI

If you are in banking, insurance, or working with a finance startup, you know that video KYC is not a foolproof method of verifying the identity of your customers yet. From impersonations to edited screenshots, synthetic identities to geolocation and device spoofing, you need to watch out for a range of identity markers that may or may not be accurate.

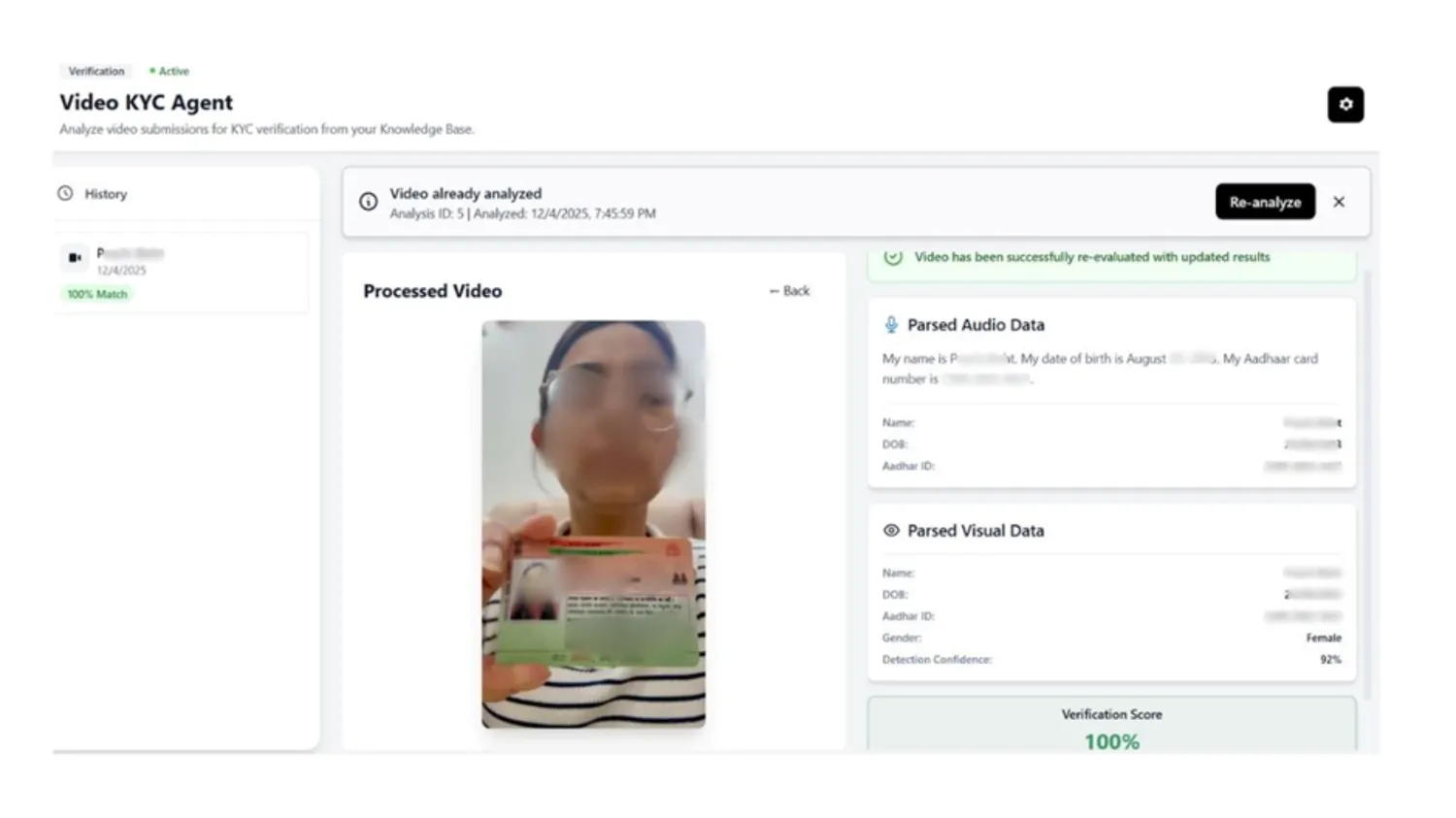

In this blog, we will show how you can use our Video KYC Agent to catch data errors, incorrect inputs, document tampering, or impersonations, while making the manual verification process quicker and smoother.

What does our agent do?

- Analyzes recorded KYC sessions

- Validates regulatory compliance

- Detects fraud indicators

- Delivers pass/fail decisions with verification scoring

How to Do Autonomous Verification at Scale

Working with our agent will reduce your manual review time by more than 70% while improving fraud detection accuracy. The agent processes each session in just under three minutes.

How It Works

Our Video KYC Agent combines multiple intelligence layers into a single verification workflow that can be purpose-built for BFSI.

- Multi-speaker detection: As part of compliance checks, the agent checks for multiple voices in a session so as to prevent off camera coaching or proxy-led verification.

- Lip-sync verification: Checks for the alignment between lip movement and the spoken audio so that it rules out the prospect of replayed videos, voice dubbing, and deepfake frauds.

- Audio environment analysis: Flags noisy, echoic, or digitally manipulated audio environments that compromise verification integrity or suggest session tampering.

- Check for Completeness of the Process: This confirms whether all the KYC processes are completed and validated.

These checks will run consistently across every session with no fatigue, bias, or variance between shifts or reviewers.

Built for Enterprise Deployment

We are an API-first platform, so it can seamlessly integrate with your system, whether it is an onboarding system, a loan origination platform, or compliance workflows. You just need to connect via standard REST APIs and, most importantly, your entire system infrastructure need not be overhauled.

Data sovereignty and regulatory compliance remain non-negotiable. NextNeural is cloud-agnostic and supports deployment on any cloud provider or on-premises environment, giving you full control over sensitive customer data and compliance with data localization requirements.

“Unlike other SaaS-only solutions that require sending PII to third-party servers, our agent operates within your security perimeter, ensuring your data remains secure.”

How Does NextNeural’s Video KYC Agent Work?

Let’s take you through the process step-by-step.

Step 1: Access the NextNeural Platform

You can first sign up on NextNeural. Since the platform is built for regulated BFSI use cases, access approval typically takes 18-24 hours and includes basic verification checks.

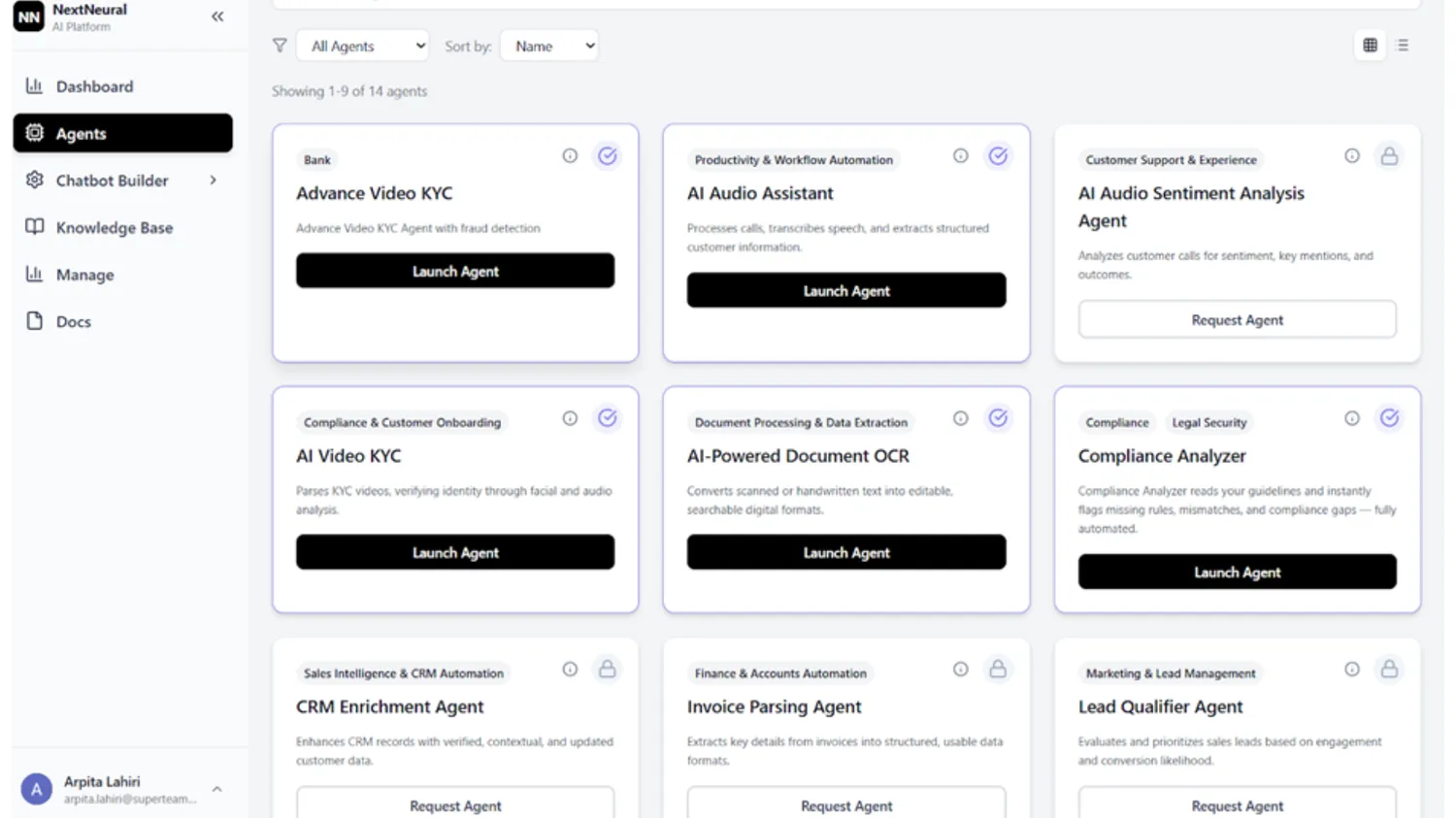

Once approved, you have access to the NextNeural dashboard where all our AI agents including the AI Video KYC Agent are centrally managed.

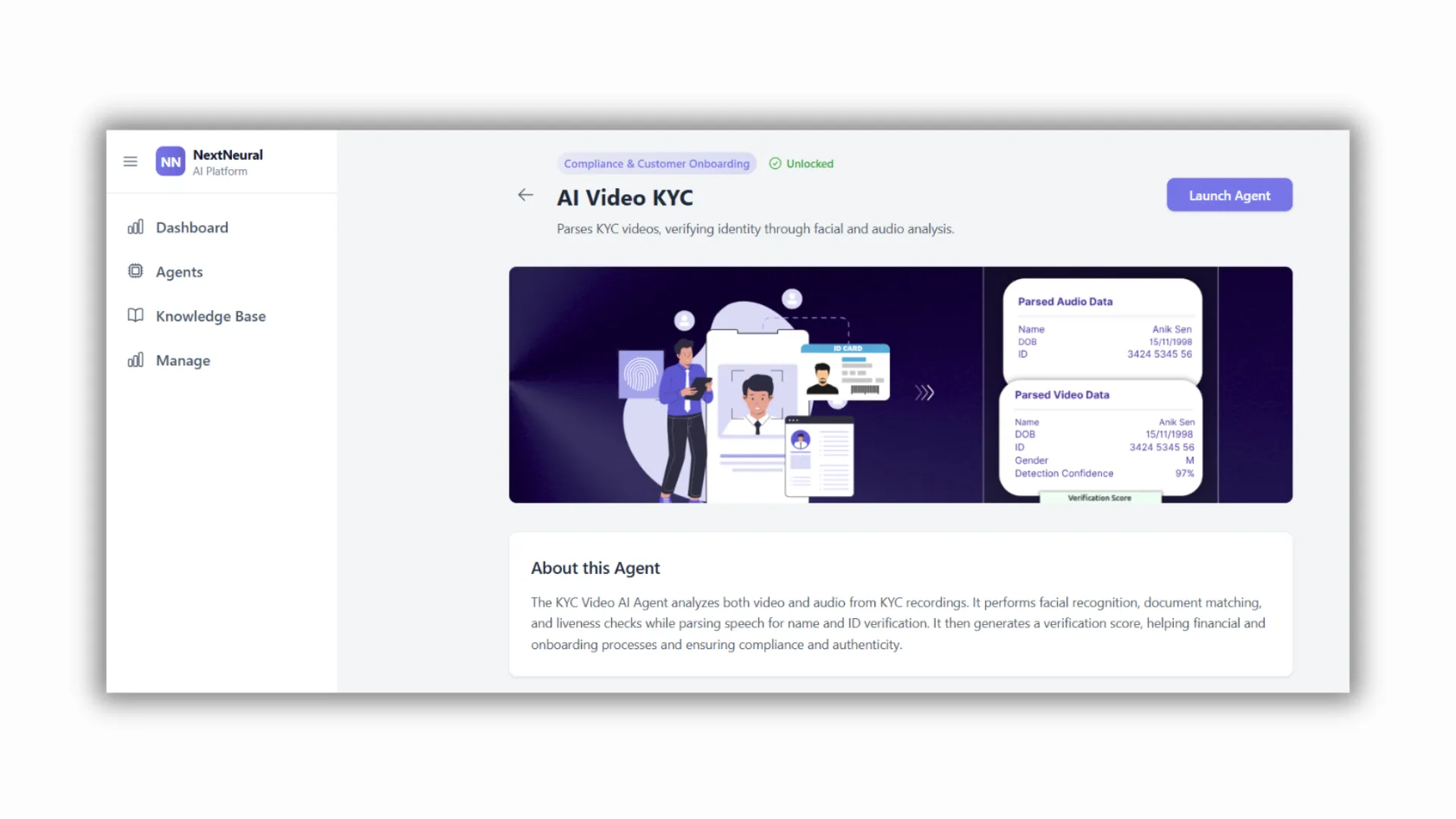

Step 2: Choose the AI Video KYC Agent

Inside the platform, you’ll see multiple AI agents designed for different enterprise workflows.

Select AI Video KYC Agent, which is purpose-built for identity verification, fraud detection, and compliance validation.

No configuration is required at this stage, as prebuilt verification logic is already aligned with standard video KYC workflows used across Indian BFSI institutions.

Step 3: Upload Sample Video KYC Sessions

To test the agent, teams can upload recorded Video KYC sessions directly through the platform.

Once a Video KYC session is submitted, our AI Video KYC Agent automatically performs the following actions:

- Extracts identity attributes from the session: Captures customer details such as name, date of birth, Aadhaar number, and gender from the spoken interaction and documents presented during the video.

- Validates identity consistency: Cross-checks extracted details against declared information to ensure there are no mismatches.

- Performs biometric and behavioral verification: Analyzes audio, speech patterns, and visual cues to assess authenticity and rule out proxy participation or manipulation.

- Calculates an overall verification confidence score: Assigns a consolidated confidence score that reflects the reliability of the identity verification outcome.

- Detects and flags fraud indicators: Automatically identifies risks such as audio inconsistencies, identity mismatches, or abnormal session patterns.

- Delivers a clear verification decision: Marks the session as evaluated with a pass/fail outcome, along with decision metadata for audit and compliance review.

We give you a verification score after analysing all the parameters. Low verification scores are flagged up and routed for human review.

What’s the Business Impact?

There are a few standard questions we receive from our customers. We’re collating them here.

Does this mean faster onboarding?

If your team was taking say 30-45 minutes to review a customer’s onboarding details, now it will take them just 3 minutes. That will help with instant same-day account opening and free your team up for other tasks.

How much does this reduce operational cost?

With less dependence on manual review, you will see more than 70% reduction in operational costs.

Does it really help prevent fraud?

Yes, deepfake detection, proxy frauds, and audio manipulation attacks are easy to slip past human review, especially when conducted under time pressure. Our agent makes your review system smarter and better equipped to deal with changing regulations.

Why AI-Powered Video KYC Matters

You may ask: do I need to implement this today? How long can I wait till this issue becomes a bottleneck and I definitely need to integrate it in my system?

Let’s break it down for you.

- Regulatory pressure is intensifying: Regulators globally are tightening scrutiny on digital onboarding fraud. Institutions found non-compliant are facing penalties, operational restrictions, or reputational damage. Multiple banks in India have had to pay fines for KYC non-compliance or negligence. That leaves little room for delay.

- Competition is moving fast: Neo-banks and fintech challengers are onboarding customers in minutes, not days. Any organisation relying on manual-first KYC processes are going to lose market share to faster digital experiences.

- Teams are expensive: As customer volumes grow, linear scaling of manual review teams creates pressure on onboarding and training as well as increases the possibility of errors.

Your Compliance Burden Can Now Be Your Growth Engine

KYC will always be a regulatory requirement. But how it’s executed will determine whether it remains a cost center or a strategic advantage.

Request a demo of the NextNeural AI Video KYC Agent to see how autonomous verification works in real-world onboarding scenarios. Discover what it means for you and your team.